Increase Deposits, eService Adoption, and Retention

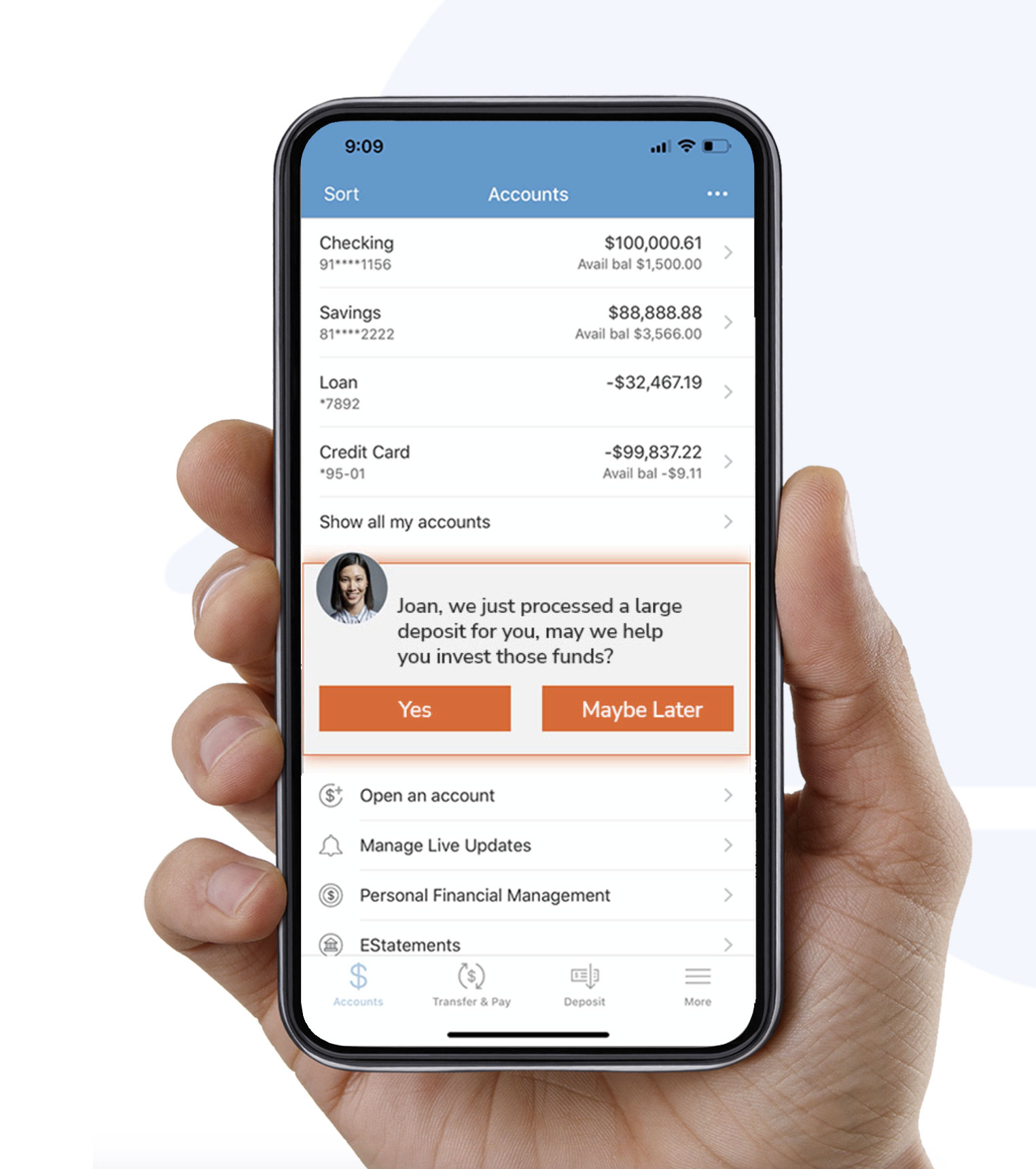

Micronotes Cross-Sell uses bank-held data, analytics, machine learning, and microinterview engagement technology seamlessly deployed through mobile/online banking, email, and SMS to deliver 26 times the click-through rate of banner ads. Implementation is seamless because Micronotes Cross-Sell is integrated with most leading mobile/online banking systems using modern APIs.

Success Metrics:

- 26 times the click through rate of banner ads

- Cut deposit leakage

- Enhanced e-Service adoption and usage

- Improved Net Promoter Score & retention

If you want to get to know your digital account-holders personally, at scale, trust Micronotes Cross-Sell to ask the right questions at the right time and generate a real sense of community.

Expand Wallet Share

Micronotes Digital Prescreen is your prescreen-in-a-box solution for always-on credit marketing to existing account-holders who hold debt with a competing institution and could save time and money by doing more loan and deposit business with your bank.

Digital Prescreen combines your account-holder data, underwriting criteria, rate sheets, and our Experian credit database containing ~230MM records to automatically deliver financially personalized firm credit offers to every qualifying account-holder.

It’s time to help your account-holders improve their financial lives by doing more business with you. They expect it, and now you can deliver with always-on Micronotes Digital Prescreen.

Expand Market Share

Micronotes Prescreen Acquire is the industry’s first credit marketing platform for community financial institutions focused on acquiring new accounts in their service area. The power of Prescreen Acquire comes from its ability to leverage 230MM consumer credit records through advanced algorithms and deliver hyper-personalized FCRA-compliant firm offers of credit for your products to creditworthy prospects in your service area(s).

Prescreen Acquire does the heavy lifting by combining underwriting criteria, rate sheets, and geotargeting to deliver email and direct mail firm offers of credit that produce higher response rates from marketing outreach. You focus on the quality and quantity of those prospects and welcoming new account-holders.

It’s time to get personal with new account-holder acquisition with Micronotes Prescreen Acquire.